This past weekend, I participated in the “We R One World” game hosted by Carolyn Tate on behalf of the Slow School of Business, and facilitated by Ron Laurie from MetaIntegral. The game is an immersive learning experience in the form of a simulated global strategy workshop, based on the work of Buckminster Fuller. I joined a team whose role was to represent the interests of the commercial banks. It was a rather sobering experience, because as the workshop unfolded, it soon became clear that in the context of the game the banks were almost redundant – which partly reflects what is going on in the real world, as banks face increased disintermediation and disruption by FinTech, crowdfunding and the shared economy.

The Premise – Earth as Spaceship

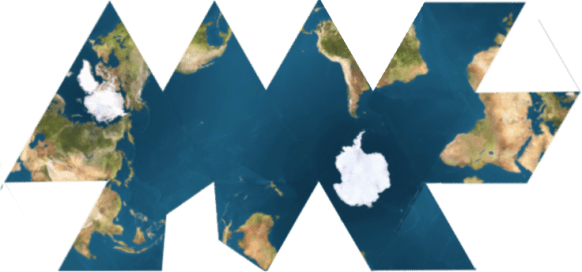

Without going into too much detail, “We R One World” mimics elements of the board games “Risk” and “Monopoly”, and takes the form of a narrative-based hackathon, combined with a meetup and an unconference. Played out on a floor-size version of the dymaxion map, the game also draws on Fuller’s concept that the Earth is a spaceship, of which the players are the crew, and the “fuel” is the inventory of global resources at the crew’s disposal, including people, technology, capital, food, energy, munitions, water, etc. The participants form teams to represent various geo-political regions, supranational NGOs, multinational corporations and banks. The goal is to achieve (through trade negotiations), the best socio-economic outcomes for everyone, with a few surprises along the way!

There is a lot of information to absorb, as well as the structure of the game. One challenge for the players is to not get hung up on the presented “data” (which is more representative, rather than precisely factual). Even though we live with access to real-time, on-line statistics and research, and despite the Internet and search engines, in real life we still experience considerable information asymmetry.

The Prelude – We Are Star Dust

As a prelude, we were shown the documentary “The Overview Effect”, which includes the comment by former Apollo astronaut Edgar Mitchell that we are made of star dust (a now common concept echoed in various songs such as Moby’s “We Are All Made of Stars” or Joni Mitchell’s “Woodstock”, depending on your musical taste/cultural perspective).

It was also a timely connection, given the increased media coverage of space exploration, and Hollywood’s renewed interest in space travel. The recurring theme (in reality as much as in fiction) is that human survival will depend on relocating to, or harnessing other planets.

As examples, in the real world, we have the latest discovery of an Earth-like planet, tweets from Philae on a frozen comet, and the remarkable images from Pluto. While the entertainment world is enjoying critical and popular success with films such as “Moon”, “Gravity”, “Elysium” and “Interstellar” (plus the forthcoming “The Martian”). Even veteran Sci-Fi writer Brain Aldiss has bowed out with his final space novel, “The Finches of Mars”.

The Banks – Increasingly dispensable

But back to the game, and what we might conclude from the outcomes.

From the start, in the role of the banks we had a strategy for encouraging “good” behaviour, and punishing the “bad”. We had a catalogue of regional problems, and a set of possible solutions. “Good” behaviour was predicated on regions finding creating solutions to their problems, based on partnering, prioritization, planning and promotion. “Bad” behaviour might include late or failed interest repayments, misuse of funds (e.g., deploying more military hardware ahead of feeding their population), or actions that led to worsening conditions (increased poverty, hunger and illiteracy, or depleted natural resources).

At the outset, the banks’ role was to manage existing loans (by collecting interest due), and to originate new loans for development and commercial projects. In the initial stages, despite Japan’s attempt to renegotiate its existing repayment terms on the fly, the commercial banks managed to collect all interest due, on time and in full (with a small surplus, thanks to some regions’ lax monetary management). One region paid up without much prompting, cheerfully (or ironically?) commenting that “we must keep the banks happy!”.

However, as the game progressed, the banks were basically ignored, as regions switched their focus to responding to new circumstances, such that the consequences of not servicing their debts seemed irrelevant. Even the risk/threat of bankruptcy did not carry much persuasion, as regions were more willing to find new ways to trade with each other, less reliant on bank capital, and more focussed on alternative value exchanges (part of the game’s secret sauce).

For example, we received only two loan applications throughout the game: one was for a worthy but ambitious development project, but when asked to resubmit the request with some further information, the loan did not materialise; and the other was more in the way of a short-term deposit with the bank, to generate interest income to buy food. Given that deposit rates are low, our response was to suggest using the capital (with additional bank funding) to increase food production, but our offer was declined, maybe because of the need to trade out of a short-term food shortage rather than investing in long-term supply.

Towards the end, the banks were almost mere spectators in the game, and were reduced to protecting their self-interests: namely their capital, and their stalled/stagnant loan assets. If borrowers don’t want the banks’ money, where and what will the banks invest in order to generate depositor, investor and shareholder returns? As one regional participant commented, “we are all bank shareholders”. Just as in real life, we deposit money with the banks, we invest in their financial products (especially through our superannuation and pension funds), and we may even buy their shares and bonds. And of course, following the GFC, many taxpayers found themselves indirect shareholders of banks that were bailed out by their respective governments.

The Conclusion – An alternative approach?

I’m not going to give the game away (you can experience it for yourself in September) but the conclusion and outcome reinforce the view that in order to tackle the world’s problems, we all have to take a different perspective – whether that is challenging existing structures, subverting traditional business models, or questioning our personal motives and objectives. For myself, I recognise that this means an increased awareness of “living lean” (mostly around personal preferences and lifestyle choices), and (multi-)lateral thinking.

For institutions like banks (as well as governments, corporations and NGOs) this alternative approach means re-assessing their roles and contribution (which can also be framed as re-connecting with their “purpose”), remodelling their processes and systems, and redefining the measures of their success. As my team member concluded, “the other players only see the banks as a source of capital, rather than a resource for knowledge, expertise and networks”.

Footnote

Declaration of interest: I participated in the game at the kind invitation of the Slow School of Business.

Next week: “I’m old, not obsolete”