A short (and seasonal) post this week, as everyone starts easing off for the holidays.

It may just be coincidence, but about the same time Amazon launched their new Australian website local retailers renewed their campaign to lower the $1,000 sales-tax exemption for online purchases from overseas retailers. And both events came at the start of the Christmas shopping season….

Obviously too early to say which way this will go, but here are a few personal observations:

First, the local Amazon site is limited to e-books, games and Android apps. So, no access to music, television or film content (digital or physical), no sales of print books and no Amazon marketplace. For these products and services, customers are directed to the US site. (Previously, the dormant Amazon.com.au domain name referred customers to the UK site.)

[Note: neither the US nor the UK sites allow overseas customers to buy mp3 content, but they can download digital music via Amazon’s AutoRip service when purchasing physical goods – confused? Me too….]

Second, prices for e-books on Amazon’s Australian site appear to be comparable to the US store, and presumably include local sales tax (GST) to keep on-side of the local real world and online retailers (as well as the ATO, of course).

Third, the general consensus is that if the $1,000 threshold was lowered or even abolished, the amount of sales tax to be collected would be more than outweighed by the additional costs of processing, administration and remittance (which would likely be passed on to local consumers at a “cost-plus” rate by overseas online retailers).

Fourth, many local retailers who voice their opposition to the $1,000 tax-free exemption fail to understand some of the reasons why local shoppers prefer to buy from overseas online retailers:

1. Price – even if overseas sales attract the 10% GST, in some cases this would still be cheaper than buying locally (especially so when the A$ was above parity with the US$). For example, from time to time, Amazon’s UK store offers free shipping on physical goods to Australia….

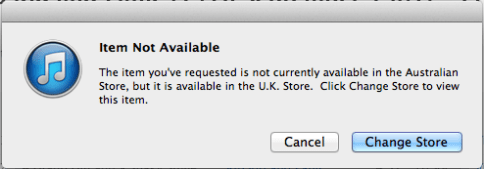

2. Choice – many products available from overseas online stores just aren’t available in Australia. This is primarily due to geo-blocking, confusion over local distribution rights, and simple lack of interest in stocking some items for the local market

3. Service – from recent personal experience, buying from a local online retailer took much longer than buying the same product from an overseas site, because the supply chain logistics were woefully inept.

[Note: As a separate but related example, I recently ordered a new iPhone 5S direct from Apple’s local website, and received it within 3 days, including a weekend; whereas my telco provider – which prides itself on its on-line business model and customer service standards – took more than 2 weeks to send me a new nano SIM card….. I had also been told by a couple of local Apple re-sellers that it would take 3-4 weeks to order the new phone, unless I took out a new mobile plan with them – which may say more about Apple’s trading policies than the resellers’ business operations.]

My advice to local bricks and mortar and even some online retailers is to look at their own limitations before insisting that the government amend the GST-free threshold on overseas online purchases.

As for Amazon, I wish them well in developing their local service. Much has been made of the stated intention to focus on Australian titles, and the opportunity for local authors to self-publish via Amazon. But already there have been some rumblings that this new site may cannibalize Kindle sales made via some of Amazon’s local retail channel partners.